Our finance minister (FM) recently announced that the major portion of the budget is dedicated to infra and the CAPEX boost. Because of the infra and CAPEX boost our economy’s expected growth seems to be double-digit. If the economy will grow then we can expect that the banking sector is also a part of the rally.

The banking and financial firms sector forms the big chunk in the indices. If we have to invest in the bank, we must know some important parameters such as NPA and CASA Ratio. So, we can easily analyse the banking stocks. We already have an article on how to analyse a banking stock over the Nonperforming assets (NPA) you can check it out on our website. In this article, we are going to learn how to analyse a bank over the casa ratio.

CASA Ratio

CASA stands for Current Accounts and Saving Account. As we know that banks are the service providers. Banks provide different types of financial services to their customers. We know that the service provided by a company is known as the product of that company. In the banking sector, banks and financial firms generate their major revenue from their loans. For that, they need the funding that they give as loans and earn interest.

For that funding, banks have an ultra-cheap product to collect funding at a low cost. Which is known as Current accounts and Saving accounts (CASA). In Current accounts, banks pay zero interest and in Saving accounts they pay only 3-4% interest which is way cheaper than other instruments such as term deposits and certificate deposits.

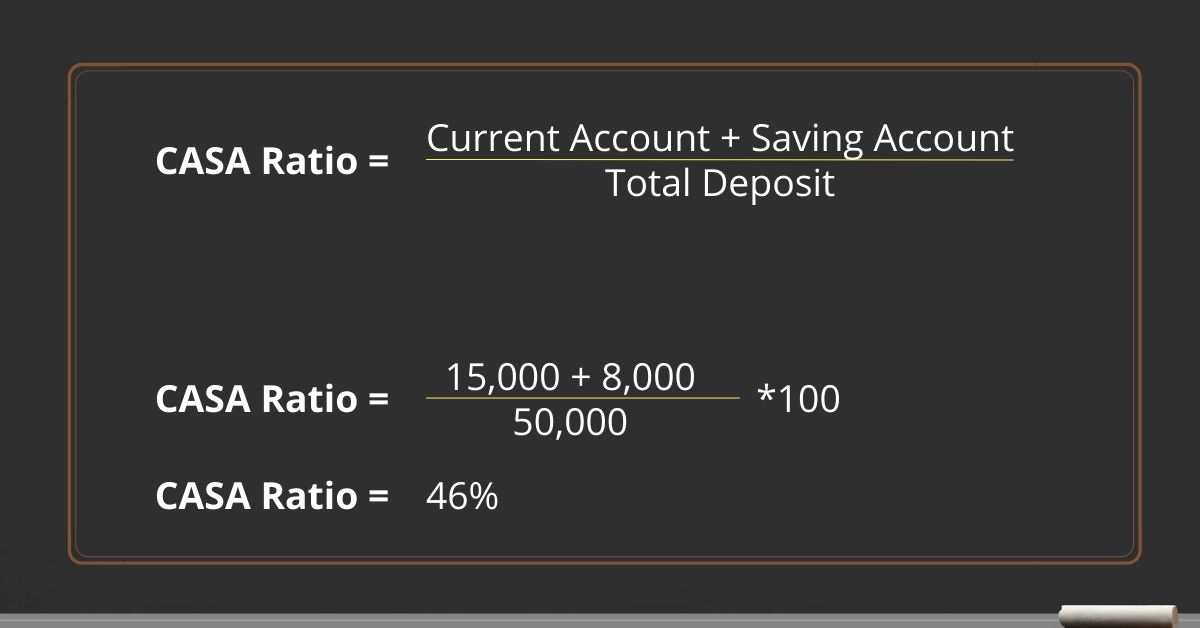

CASA deposits are the club deposits of Current account deposits and saving account deposits. In simple words, CASA deposits are calculated by the sum of the current account deposit with the saving account deposit. Let’s understand it with an example. Suppose a bank has a total deposit of 50,000 crores. They have saving account deposits and current account deposits of 15,000 crores and 8,000 crores respectively. So, as you can see in the below image the CASA ratio will be calculated as 46%. It means that 46% of total deposits are contributed by the Current account and Savings Accounts.

Importance of CASA Ratio

Generally, we can say banks borrow that money which is in Current accounts and saving accounts and lend them as loans to need at the interest rates of around 10%. They just pay borrowers 3-4% interest and in the Current account, this is zero. So, the profit margin in this particular segment is way higher in comparison to others.

While analyzing the banking stocks we must see the CASA Ratio. If the CASA Ratio is high then it means that the bank has more Current account and saving account deposits. Also, we can consider higher CASA Ratio means higher profitability.

Open a Demat Account Right Now and Start Investing: Sign Up Now

Drawbacks

As we all have at least one saving account we can deposit and withdraw the money at any time. That means these deposits can move out from the bank’s book at any time. That’s why for long-term finance projects banks rely on term deposits like FD and bonds rather than Current account and saving account deposits. Because term deposits are generally not withdrawn before the maturity period.