A Beginner’s Guide on How to read monetary statements of a company: If you wish to make investments efficiently within the stock market, it’s essential to discover ways to learn and understand the monetary reports of a company. Financial statements are instruments to judge the monetary health of the company. In this post, we’re going to talk about the fundamentals of how one can read the monetary statements of a company. Here you’ll discover ways to read the balance sheet, income statement, and cash flow statement of a company.

To be honest, you won’t discover this post very interesting. Many of the points may sound advanced and boring. However, it’s actually vital that you just discover ways to learn financial statements of a company for reaching success in your investing journey. Reading and understanding the financials of an organization is what differentiates an investor from a speculator.

Warren Buffett said “Risk comes from not knowing what you are doing.”. And you’ll find the risk and potentials of an organization by its monetary reports. Without wasting any additional time, Let’s get started.

Table of Contents

- How to get the financial statements of a company?

- Three Core Financial Statements of A Company

- How to learn financial statements of an organization?

- 1. Balance Sheet

- 2. Income Statement

- 3. Cashflow statement

- Summary

How to get the financial statements of a company?

Before we begin analyzing the financial statements of an organization, the very first thing that you need to know is where precisely to find them. Where are you able to see or obtain the financial statements of an organization that you’re researching?

Well, you’ll find the financial statements of an organization in any of the following websites: 1) BSE/NSE Website, 2) Investor relation page on Company’s web site 3) Financial web sites (like screener, money control, investing, and many others)

In India, Securities exchange board of India (SEBI) regulates the financials introduced by the company and try to keep it as fair as possible. Further, if you’re using another non-reputed web site, make sure that the reports are appropriate and never tempered.

Three Core Financial Statements of A Company

Now, allow us to understand the totally different financial statements of an organization. The financials of an organization are cut up into three key sections. They are:

- Balance sheet

- Income statement (Or Profit & loss statement)

- Cash flow statement.

The balance sheet shows the assets and liabilities of an organization i.e. what it owns and owes. Second, the income statement shows how much profit/loss the corporate has generated from its revenues and expenses. And lastly, the Cash flow statement exhibits the inflows and outflows of money from the company.

It’s important that you understand how to read all of those financial statements. Let’s understand every statement one-by-one.

How to read financial statements of a company?

1. Balance Sheet

A balance sheet is a financial statement that compares the assets and liabilities of an organization to find the shareholder’s equity at a specific time. The balance sheet adheres to the following formula:

Assets = Liabilities + Shareholders’ Equity

Here, don’t get confused by the term ‘shareholder’s equity’. It is simply one other name for ‘net worth’ of the company. In different way, the above method might be additionally written as:

Shareholder’s Equity = Assets – Liabilities

Quick Note: You can simply understand this with an instance from daily life. If you own a pc, automobile, home, and many others then it may be considered as your asset. Now your private loans, bank card dues, and many others are your liabilities. When you subtract your liabilities from your assets, you’ll get your net worth. The same concept is applicable to companies. However, here we outline net worth as the shareholder’s equity.

Why are balance sheets important?

The balance sheet helps an investor to judge how an organization is managing its financials. The three balance sheet segments- Assets, liabilities, and equity, give investors an idea as to what the corporation owns and owes, in addition to the amount invested by shareholders.

Key elements of a Balance Sheet

Assets and liabilities are two key elements of a balance sheet. However, both assets and liabilities further comprise of various parts. Let’s outline each of those to understand them in details:

1) Assets: It is an economic value that an organization controls with an expectation that it’ll provide a future benefit. Assets might be money, land, property, inventories, and many others. Further, assets might be broadly categorized into:

- Current (short-term) assets: These are those belongings that may be shortly liquidated into money (within 12 months). For instance money and money equivalents, inventories, account receivables, etc.

- Non-Current (Fixed) assets: Those belongings which take greater than 12 months to transform into money. For example- Land, property, tools, long-term investments, Intangible assets (like patents, copyrights, trademarks), etc.

The sum of those assets is known as the total belongings of an organization.

2) Liabilities: It is an obligation that an organization has to pay in the future as a consequence of its previous actions like borrowing cash when it comes to loans for business growth purposes and many others. Like assets, it may also be broadly divided into two segments:

- Current liabilities: These are the obligations that should be paid within 12 months. For instance payroll, account payable, taxes, short-term debts, and many others.

- Non-current (Long-term) liabilities- There are these liabilities that should be paid after 12 months. For instance long-term borrowings like term loans, debentures, deferred tax liabilities, mortgage liabilities (payable after 1 year), lease funds, trade payable, and many others.

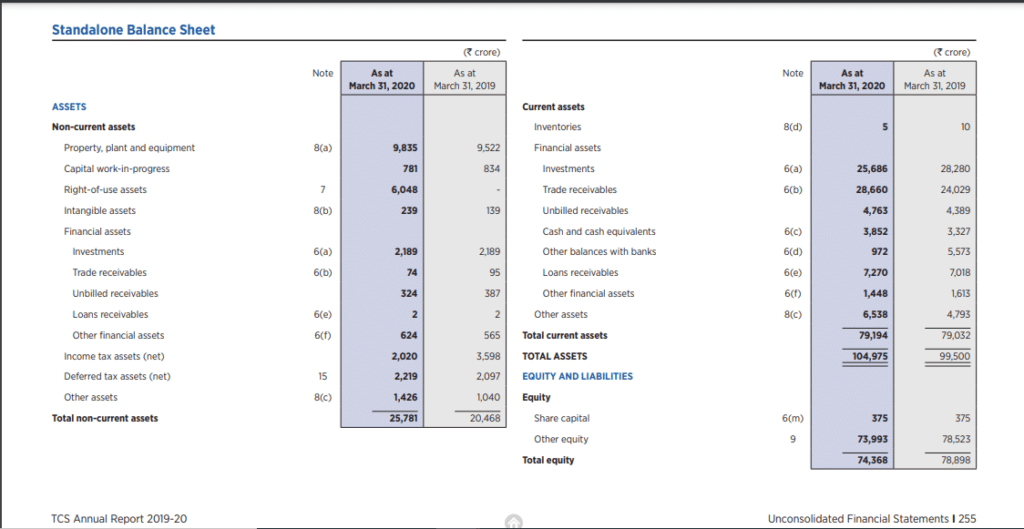

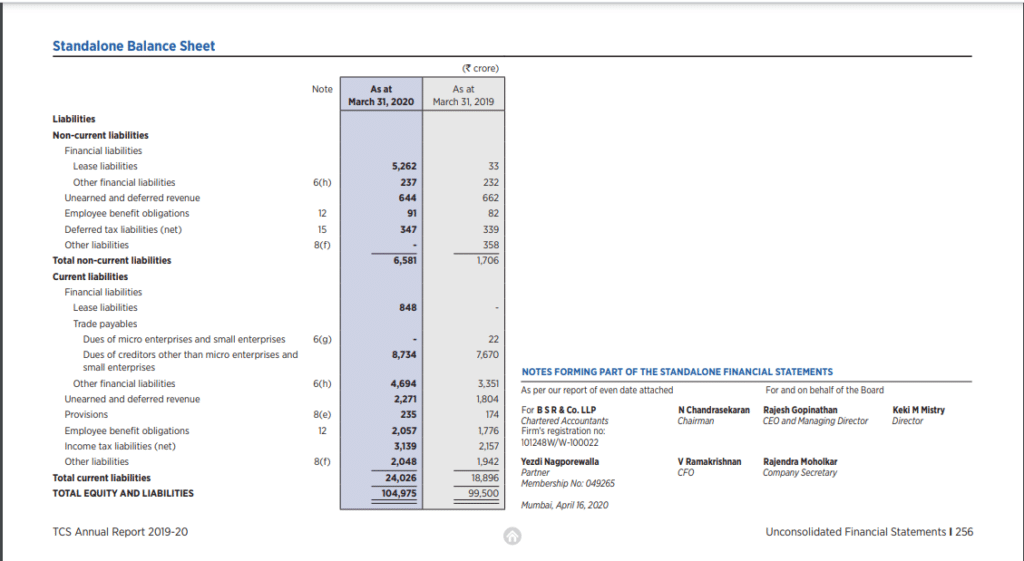

Now, allow us to understand these segments with the assistance of the balance sheet of a company from the Indian stock market. Here is the balance sheet of TCS for the fiscal year 2019-20. I’ve downloaded this report from the company’s web site here.

Please note that there are at all times at least 2 columns on the balance sheet for consecutive fiscal years. It helps the readers to observe the year-on-year progress.

Source: https://on.tcs.com/Annual-Report-2020

Although the balance sheet seems difficult, however, once you learn the fundamental structure, it’s simple to grasp how to read the financial statements of an organization. A number of factors to notice from the balance sheet of TCS:

- There are three segments within the balance sheet of TCS: Assets, equity, and liability.

- It adheres to the fundamental formula of the balance sheet: Assets = Liabilities + Shareholder’s equity. Please note that the first column of asset (TOTAL ASSETS = 104975) is the same as the second & third column of equity and liabilities (TOTAL EQUITY & LIABILITY = 104975).

Now, allow us to move to the second important financial statement of an organization.

2. Income Statement

This can be referred to as the Profit and loss statement. An income statement summarizes the revenues, costs, and expenses incurred throughout a selected period of time (usually a fiscal quarter or 12 months). The primary equation on which a revenue & loss assertion relies is:

Revenues – Expenses = Profit

In easy words, what a company ‘takes in’ is known as revenue and what a company ‘takes out’ is known as expenses. The distinction within the revenues and expenses is net profit or loss.

The basic structure of an income statement:

Revenue

– Cost of goods sold (COGS)

——————————————-

= Gross Profit

– Operating expenses

——————————————-

= Operating Income

– Interest expense

– Income taxes

——————————————–

= Net Income

Note: The revenue is known as TOPLINE and net income is known as the bottom line in the income statement.

Most of the investors verify the income statement of a company to seek out its earning. Moreover, they search for growth in their earnings. It’s preferable to invest in a profit-making firm. A company can not develop if the underlying business will not be creating wealth.

Here is the Income statement of TCS for the Year 2019-20:

Here are a number of factors that you must note form the income statement of TCS:

- The top line (revenue) increased by 6.56% within the fiscal year 2019-20.

- On the opposite hand, the bottom line (net profit) increased by 10.62% (Rs 30065 Cr –> Rs 33260 Cr) in the from the fiscal year 2018-19 to the fiscal year 2019-20.

- This exhibits that the management has been in a position to improve the profits are a greater pace compared to the sales. This is a healthy sign for the company.

For TCS, the diluted EPS additionally increased from Rs 79.34 within the year 2018-19 to Rs 88.64 in year 2019-20. This is once more a positive signal for the company.

Also learn: 10 Ways to Generate Passive Income.

3. Cashflow statement

This is the third key part of a company’s finances. Cash flow statement (also called statements of cash flow) shows the flow of cash and cash equivalents in the course of the period under report and breaks the analysis down to operating, investing, and financing activities. It helps in assessing the liquidity and solvency of a company and to verify efficient cash administration.

Three key elements of Cash flow statements

- Cash from operating activities: This contains all of the money inflows and outflows generated by the revenue-generating actions of an enterprise like sale & purchase of raw materials, items, labor cost, building stock, promoting, and shipping the product, and many others.

- Cash from investing activities: These actions include all money inflows and outflows involving the investments that the company made in a specific time interval such as the acquisition of latest plant, property, tools, improvements capital expenditures, the money involved in buying other companies or investments.

- Cash from financial activities: This exercise contains inflow of money from investors such as banks and shareholders by getting loans, offering new shares, and many others, in addition to the outflow of money to shareholders as dividends as the corporate generates earnings. They reflect the change in capital & borrowings of the business.

In easy words, there might be money inflow or money outflow from all three activities i.e. operation, investing, and finance of an organization. The sum of the total money flows from all these activities can tell you how much is the company’s whole money inflow/outflow in a specific period of time.

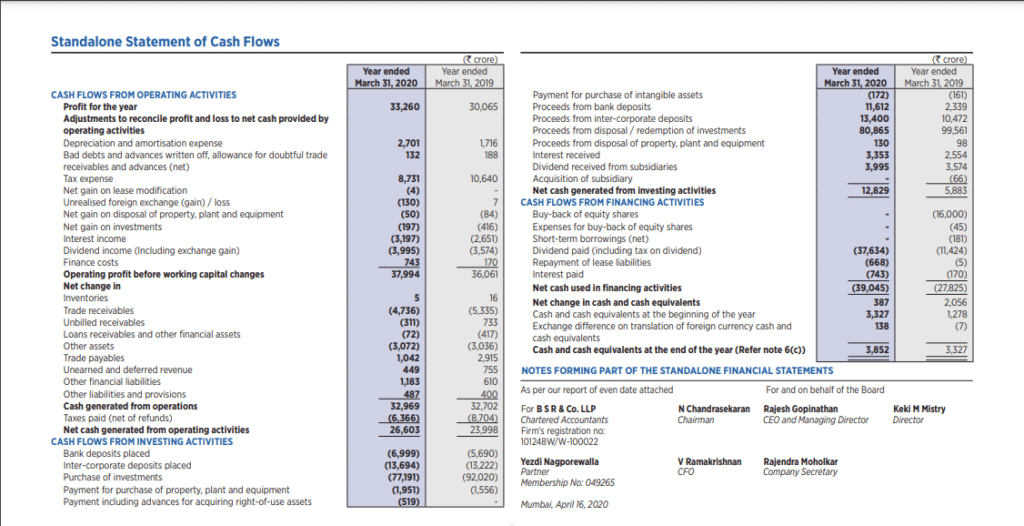

Here is the Cash flow statement of TCS for the fiscal year 2019-20.

From the TCS cashflow statement, we will discover that the net cash from operating activities has increased from Rs 23,998 Crores to Rs 26,603.

As a thumb rule, a rise within the net cash from operating activities year over year is considered a healthy signal for the company. However, whereas comparing also look at the information for multiple years.

Quick word: In financial statements, usually accountants don’t use the negative sign. For instance, if the expense is to be deducted, it’s not written as -40. When writing minus sign, accountants use parentheses (—). For the same example, it will be written as (40), not -40.

Also Read – Youth taking a great interest and emerging as a smartest of all stock investors…

Summary

Through this post, we tried to explain the three core financial statements of an organization. It is vital to learn and understand all of the three financial statements of an organization as they show the well being of an organization from different aspects.

- The balance sheet shows the belongings and liabilities of an organization.

- The income statement shows how much profit/loss the company has generated from its revenues and bills.

- Cash flow statement shows the inflows and outflows of cash from the company.

While investing in a company, you must pay special attention to all these financial features of an organization. As a thumb rule, invest in a company with high-income growth, large assets compared to its liabilities and a high cash flow.

That’s all! This is how one can learn financial statements of a company. Although it’s not sufficient, nonetheless, this post aims to present a primary idea to the beginners concerning the financial statements of a company.