How much should you save — This is likely one of the biggest questions that comes to everybody’s mind when we discuss budgeting. The significance of smart budgeting can’t be overstated as excessive spending and irregular saving habits can result in disasters sooner or later.

If you wish to take pleasure in a healthy financial life, it’s actually essential to have a stability between your financial savings and your bills. And budgeting for people helps to align the spendings with financial savings and determining how much to spend on what.

If you’re additionally struggling with personal finance, then this publishes could also be a holy grail for you. In this post, we’re going to talk about one of the many best budgeting methods to determine how much do you have to save. And it’s referred to as the 50/20/30 Strategy.

50/20/30 Rule Strategy

This technique may be extraordinarily useful for youngsters who’re simply coming into the world of personal finance and don’t know how to handle their spendings. Originally developed by Elizabeth Warren and Amelia Warren Tyagi, this technique is superbly described in their book — All Your Worth: The Ultimate Lifetime Money Plan.

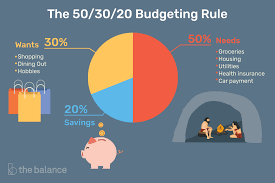

50/20/30 is a extremely easy and simple budgeting technique that may assist you to to outline how much do you have to spend in your important spendings (needs), financial savings and eventually in your preferences (desires and choices). According to 50/20/30 technique, it’s best to allocate:

- 50% of your month-to-month earnings on ‘Needs’ (like rent, meals and so on)

- 20% of your month-to-month earnings on ‘Savings’ (like your retirement fund, investments and so on)

- And the remaining 30% of your month-to-month earnings in your ‘Wants’ (like traveling, eating out and so on)

(Image Credits: The Balance)

Now, allow us to perceive all these three spending allocations in particulars.

We support book reading.

Buy and Read – Bestsellers

50% of your earnings on Needs

As soon as you get your in-hand salary (i.e. your month-to-month earnings after deducting taxes), put aside round 50% of this earnings to pay for the things which are important in your day-to-day life. The expenses on this category may be spendings on rent, meals, transportation, utilities, health care, fundamental groceries, insurances and so on.

Although allocating half of your month-to-month earnings in ‘needs’ could appear massive. However, when you take a look at the objects on this list, it is sensible to allocate around 50% of your earnings in your needs.

Anyways, in case you aren’t capable of handle your needs within 50% of your month-to-month earnings, you may have to optimize your way of life. For example, as a substitute of living in a fancy home in a fancy locality which is just too far from your workspace and adds transportation costs, you might wanna move in an inexpensive home with walkable distance to your workplace.

20% of your earnings on Savings

Once all of your essentials are paid, subsequent it’s worthwhile to allocate the 20% of your month-to-month earnings on financial savings. This category contains compensation of debt like a student loan, credit card debt and so on together with investing the remaining on your future goals and retirement.

It’s actually essential that you simply allocate 20% of your earnings on this category before transferring on to the next one i.e. spending in your ‘Wants’.

Quick Note: Looking for the most effective Demat and Trading account to start out your investing journey? Click here to open your account with the No 1 Stockbroker in India

30% of your earnings on Wants/Personal decisions

This is the final category in your personal budgeting. Once you’re done along with your necessities and financial savings, the ultimate spendings must be on the things that you really want. The expenses on this category embody spendings on shopping, traveling, leisure, eating out and so on.

This record may additionally cowl a number of obscure bills like Netflix subscription, membership to clubs, weekend journeys and so on depending on your way of life. However, guarantee that your spendings don’t cross the allotted price range of 30% of your month-to-month earnings.

Example:

Let’s say that you simply make Rs 1 lakh monthly (in-hand earnings after paying taxes). As quickly as you get your wage, it’s worthwhile to allocate

- Rs 50k in meeting your day-to-day necessities like rent, meals and so on.

- Rs 20k in paying your debts and financial savings.

- And the remaining Rs 30k in your private alternative like eating out, touring, memberships and so on.

Using this easy budgeting technique, you won’t run out of cash to satisfy your day by day wants, constantly contribute in the direction of your future and retirement financial savings, and also can spend guilt-freely in your personal choices.

Also learn: 10 Ways to Generate Passive Income.

A few different popular saving strategies:

Apart from the 50/20/30 technique, listed below are two different in style methods that may additionally assist you to to determine how much do you have to save.

- 10% rule: This rule says that it’s best to save a minimum of 10% of your month-to-month earnings, it doesn’t matter what the circumstances. This technique is brilliantly defined within the book — The Richest Man in Babylon and works nicely for the people who find themselves struggling to economize. The fundamental ideology behind this technique is to ‘Pay yourself first’ and preserve 10% of your financial savings solely to your self.

- 100 minus your age rule: This rule tells that it’s best to save a minimum of the proportion of your earnings which is the same as 100 minus your age. For instance, in case you are 30 years old right now, then it’s best to save (and make investments) a minimum of 100–30 = 70% of your month-to-month earnings. This rule is predicated on the principle that the expenses improve as you get older (like youngsters, dependents and so on) and therefore it’s best to save and make investments more if you find yourself younger.

Conclusion:

Although 50/20/30 budgeting technique could appear just a little tough at first, nonetheless, with self-discipline and persistence — it’s followable. Moreover, this budgeting technique doesn’t rely on how much you earn. Even individuals with average to low wage range can observe this technique if they’re able to optimize their way of life just a little.

Anyways, the very last thing that I want to add is that don’t take the rule too-damn significantly. I mean, don’t freak out in case your important spending crosses over 50% in a month. Sometimes, you might have to review your earnings and bills and make changes within the budgeting technique.

For instance, if you believe that your needs are much less — let’s say you already own a home and therefore you don’t have to pay any rent, however your personal desires are extra, then you’ll be able to observe the 40/20/40 strategy .

On the opposite hand, in case your important expenditures are excessive — let’s say you pay a heavy month-to-month rent, however your personal desires are low, then you might favor 60/20/20 technique 60% spending on needs, 20% spending on financial savings and 20% spending on desires/private selections. Nonetheless, no matter technique you favor, try to allocate a minimum of 20% of your month-to-month income in financial savings.

Remember- ‘A Penny Saved is a Penny Earned’.